Who needs a form CA 3822?

When a company from the United Kingdom sends its employee to work in the countries of the European Economic Area, its HR representative has to file this form at HM Revenue and Customs (HMRC).

What is form CA 3822 for?

Form CA 3822 informs HMRC of the employee’s country of destination. Each member state of the European Economic Area has different view on social security, so HMRC has to provide different documents for protecting its citizen overseas.

Is it accompanied by other forms?

It should be accompanied by other forms. The employer must keep in mind that if it’s the first time he sends his employee to work in the EEA member state, he needs to fill out form CA3821, not this one, and if the employee is going to work in several EEA countries simultaneously, he should complete and send form CA8421.

When is form CA 3822 due?

The expiration date will be assigned by the HMC representative.

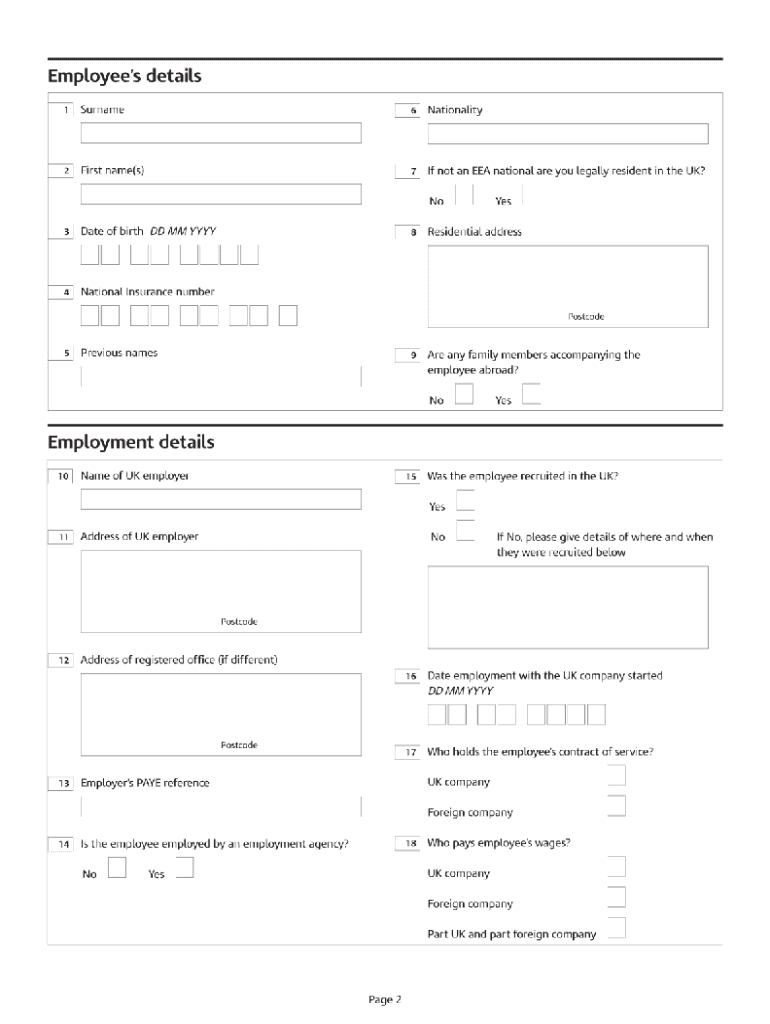

How do I fill out form CA 3822?

This form consists of only two pages, so it will not take long to fill out. Give all the necessary info about your employee on the first page and describe his assignment on the second page. Also add the previous posting details to the job description.

Where do I send it?

Once the form is done, send it to the following address:

NICO International Caseworker

BP1301

HM Revenue and Customs

Benton Park View

Newcastle Upon Type

NE98 1ZZ

United Kingdom